[ad_1]

March 16, 2023

After the tumultuous 12 months 2022, it regarded like 2023 was off to a fantastic begin. However banks threw a monkey wrench into the machine, with the S&P nearly erasing the spectacular YTD positive factors, a number of financial institution failures, and the prospect of a worldwide banking disaster that each one modified. So of us contacted me and requested me if I may weigh in on this and another points.

Listed here are a few of my musings about financial institution failures, authorities failures, ethical hazard, and why the FDIC ought to eradicate the $250k restrict and easily insure all deposits…

Financial institution Runs in Apply: The Silicon Valley Financial institution Failure

My running a blog buddy Mr. Shirts wrote a wonderful autopsy concerning the beautiful Silicon Valley Financial institution (SVB) failure, and I extremely advocate you take a look at his publish. In a nutshell:

- SVB skilled giant inflows of deposits over the previous few years. Many of the deposits exceeded the $250k FDIC-insured restrict. That’s as a result of many depositors have been startups who obtained sizable money injections from VC corporations and wanted to retailer that cash someplace “secure,” like a checking account at SVB.

- SVB wasn’t closely concerned within the conventional financial institution enterprise like loans and mortgages. Startups don’t normally get conventional financial institution loans. So, to generate income off all these deposits, SVB invested a big chunk of its property in interest-bearing property, like Treasury bonds, Mortgage-Backed Securities (MBS), and so forth. All very secure devices with basically zero credit score danger.

- The asset portfolio was closely biased towards longer-maturity bonds to earn extra curiosity earnings. As you all recall, bonds went by a brutal bear market final 12 months after the Federal Reserve moved up short-term charges from zero to nearly 5% at the start of 2023, taking all longer-maturity bond yields with it for the experience. SVB discovered painfully that Treasury bonds may not have credit score danger, however the period danger will be simply as unhealthy!

- With a steadiness sheet underwater and plenty of fickle depositors fearful about dropping their uninsured deposits above the $250k restrict, a financial institution run ensued. Clients have been lined up outdoors their branches and wrapped across the block, invoking disagreeable recollections of the Nineteen Thirties. However in fact, the demise blow got here from $42b of digital withdrawals, properly coordinated by the Silicon Valley VC group. With mates like these, who wants enemies?

Companies fail on a regular basis. A financial institution is a enterprise, too, so what’s the massive deal a few financial institution failure, then? Easy: traders now surprise what number of extra SVBs are on the market. That’s a novel function of the monetary sector. In distinction, when you run a sandwich store and considered one of your rivals goes out of enterprise, you would possibly even have a good time; much less competitors possible means extra revenue for you.

However within the banking sector, three financial institution failures in lower than per week will put the whole trade below scrutiny. Everyone is responsible by affiliation. Typically, even wholesome banks can fail throughout a coordinated financial institution run. It could be mightily disagreeable if a financial institution failure in California or New York drags down the whole world banking system. As a lot as I’m a free-market capitalist in lots of different features, there are causes for the federal government to step in and help the banking system due to systemic contagion danger.

How can wholesome banks get sucked right into a disaster? This brings me to the subsequent merchandise…

Financial institution Runs in Concept: The Diamond-Dybvig Mannequin

The Diamond-Dybvig Financial institution Run mannequin was revealed in 1983 (“Financial institution runs, deposit insurance coverage, and liquidity.” Journal of Political Financial system. 91 (3): pp. 401–419). Intriguingly and in an outright creepy coincidence, Professors Diamond and Dybvig obtained the Nobel Prize in Economics in late 2022 for this work, alongside well-known macroeconomist and former Fed Chairman Ben Bernanke for his (separate) tutorial work in understanding monetary crises. You may’t make this up; possibly the oldsters on the Sveriges Riksbank knew extra concerning the coming chaos in 2023 than our U.S. regulators, however I’m not into conspiracy theories.

In any case, in a Diamond-Dybvig mannequin (DDM), you may have a very wholesome financial institution with adequate property relative to its deposits. Nevertheless, suppose all depositors, in a coordinated assault, wished to withdraw all their deposits. In that case, the financial institution may not get a good market value for all property and should now liquidate property at “firesale” costs. The proceeds might now fall in need of satisfying all depositors.

In essence, the mannequin creates two equilibria. If the opposite prospects don’t withdraw their funds, I’ve no incentive to take action both, and the financial institution retains working as ordinary. Then again, if a vital mass of depositors withdraws cash, then I don’t wish to be final in line and left holding the bag. Thus, whether or not I would like the cash or not, I take part within the run, too.

So, even a wonderfully wholesome financial institution may fail on this disagreeable equilibrium. Additionally, the failure has nothing to do with Ethical Hazard. It’s a self-fulfilling prophecy that takes down an in any other case wholesome financial institution. As a coverage suggestion, Professors Diamond and Dybvig identified that deposit insurance coverage can enhance outcomes and break the vicious cycle of a financial institution run. Notice that the absence of deposit insurance coverage could cause a financial institution run. And deposit insurance coverage can stop a financial institution run. It’s the reverse of ethical hazard!

However for the file: SVB was not wholesome!

The distinction between SVB and the financial institution in a Diamond-Dybvig mannequin is that SVB was unhealthy. It was underwater, not as a result of illiquid property wanted to be liquidated at firesale costs. Treasury bonds commerce in a really liquid market, and bond costs have been down not due to a firesale however as a result of the Fed raised short-term charges, shifting the whole yield curve as nicely. Thus, SVB was bancrupt even at honest and aggressive market costs, not simply firesale costs. Worse, SVB was mathematically bancrupt earlier than the financial institution run even started! It wasn’t a multiple-equilibrium downside. There was just one single equilibrium, and that’s referred to as “SVB is toast!”

It’s possible you’ll ask, don’t we have now regulators? How did this go undetected? This brings me to the subsequent level…

Regulators failed!

If SVB had recurrently valued its property at market costs, a course of referred to as mark-to-market, the outlet within the steadiness sheet would have been obvious in a short time. Nevertheless, SVB used an accounting trick to cover this gap. A financial institution can preserve two buckets of property: property accessible on the market (AFS) have to be marked to market. Property the financial institution intends to carry to maturity (HTM) don’t must be written down in response to cost drops. The logic behind that is that throughout the World Monetary Disaster (GFC), many banks needed to write down their mortgage and mortgage portfolios. No person wished to the touch these property, and the market priced them at steep reductions. So, on paper, a financial institution might look bancrupt, however solely when making use of fire-sale-like costs. In distinction, these property may have possible paid off if held to maturity. However this two-bucket strategy was supposed to keep away from the results of dramatic value drops of extremely illiquid property, not the market repricing of extremely liquid Treasury bonds.

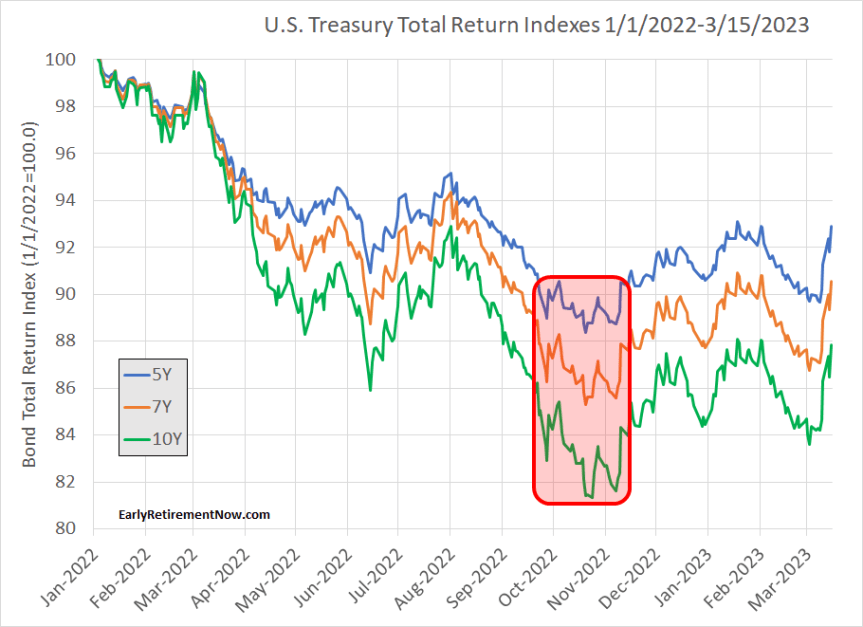

This begs the query, why didn’t banking regulators catch as much as this? It’s not like bond yields only recently rallied. Certainly, U.S. Treasury yields in early March 2023 have been nonetheless nicely under their October 2022 peaks. If SVB was bancrupt on March 10, it ought to have been in even worse form between late September and early November 2022. As you possibly can see within the chart under, Treasury whole return indexes have since recovered a little bit bit. If that is all attributable to a period impact, why didn’t the FDIC and Federal Reserve Financial institution of San Francisco act six months in the past? Why wait for therefore lengthy to aim to recapitalize SVB? The danger managers at SVB and the “consultants” on the related authorities regulatory businesses will need to have been asleep!

Ethical Hazard

One widespread fantasy is that banking crises end result from Ethical Hazard as a result of reckless bankers performed a sport of HIWTTGBMO – “Heads I win, tails the federal government bails me out.” I discover that story very unconvincing. Not simply because the Diamond-Dybvig mannequin generates financial institution runs with none ethical hazard. But in addition as a result of I’ve labored in finance all my life. Between 2008 and 2018, whereas working in asset administration at BNY Mellon, I operated below the precept “If I do nicely, I receives a commission nicely. If I screw up, I lose my job, status, CFA constitution, and cash, and relying on the severity of the screw-up, I may be banned for all times from working within the securities trade once more.” I at all times felt these incentives have been fairly nicely aligned with what’s greatest for the banking world and society at giant.

The closest I got here to HIWTTGBMO was throughout my time on the Federal Reserve: “Heads, I get a authorities wage and advantages, Tails I get a authorities wage and advantages.” In fact, I labored in financial analysis with none potential to trigger hurt to the actual financial system, however I’m positive that the financial institution examiners on the FDIC and Federal Reserve Financial institution of San Francisco that have been asleep on the wheel will preserve their jobs and pensions and can preserve working as ordinary after this. If persons are searching for a Ethical Hazard downside to unravel, possibly begin with the regulators!

Above all, I can’t emphasize sufficient that the bailout cash goes to the shoppers, not the financial institution managers or fairness homeowners. The financial institution management and workers will possible all lose their jobs, and the oldsters proudly owning SVB shares will lose their funding. By the way in which, we’re all losers if we have now cash invested in U.S. fairness index funds as a result of SVB was sufficiently big to be within the S&P 500 and positively sufficiently big to be in your U.S. Whole Inventory market Index. So all of us bear the price of the failure, and as fairness traders, we must always accomplish that.

So, from a strictly financial perspective, the ethical hazard downside happens on the aspect of the depositors, not the financial institution management. As a result of depositors have protection by the Federal Deposit Insurance coverage Company (FDIC), they could certainly “recklessly” deposit their cash at weak under-capitalized banks led by a bunch of Yahoos. However realistically, what’s the choice right here? There may be an uneven data downside. Even when all of us have been finance and accounting consultants, we don’t have entry to personal financial institution information. You may’t require everybody to be CFO-grade consultants for each financial institution we do enterprise with! With the $6.8t Joe Biden needs to spend yearly, the federal government ought to regulate banks successfully and reliably so we are able to all think about our personal companies. You recognize, to have the ability to pay for these taxes to fund a $6.8t-a-year authorities!

In protection of bailing out funds above $250,000

I’ve by no means had greater than $250,000 at anybody financial institution. I normally preserve lower than $2,500 in my checking account at Wells Fargo. In fact, I’ve greater than that at Constancy, however the cash there may be in index funds, so the failure of a brokerage doesn’t jeopardize the funding as a result of these funds are held in custody away from Constancy’s steadiness sheet.

So, since I’m so clearly under the $250k FDIC restrict, does that imply I couldn’t be bothered if giant companies lose their deposits in a financial institution failure? In fact not. As an economist, I care concerning the environment friendly functioning of the financial system, and though I don’t have a horse on this race, I discover it unfair that the FDIC insures funds solely as much as $250k.

Ought to Chief Monetary Officers divert time and assets away from monetary planning at their very own firms to observe the well being of the monetary establishments they financial institution with? That’s certainly what the ethical hazard talking-head clowns are telling us: in line with them, retail traders shouldn’t be bothered about researching banks as a result of we’re so dumb. However abruptly, companies are such skilled monetary wizards that they will see by all of the uneven data issues inherent in banking. Basically, they’re telling us that giant enterprise purchasers of SVB should have higher insights into the financial institution’s asset and legal responsibility positions than even the CFO and CRO (Chief Danger Officer) at SVB. And the financial institution consumer’s CFO should have higher insights than even the federal government banking supervisors, e.g., the Federal Reserve and FDIC, who’ve entry to a financial institution’s personal information. Come on, let’s be life like. Enterprise purchasers face the identical uneven data issues as retail purchasers. If mom-and-pop checking accounts are insured, then so ought to enterprise checking accounts as much as any degree.

And what concerning the recommendation of spreading your funds to a number of banks? It really works for retail purchasers however not for companies. Let’s take a medium-sized firm with 1,000 workers and a month-to-month payroll of $10m. That firm most likely has a minimum of $20m in money sitting in a company checking account to fulfill month-to-month money circulate wants. Will we inform this firm that it ought to simply unfold its cash over 80 totally different banks to remain under the $250k restrict? And if the corporate will get paid by a buyer, will it ask for 80 totally different checks or 80 totally different ACH transfers to go to these totally different accounts? If companies operated that means, they’d be busier managing their financial institution counterparty danger than operating their very own affairs. And enormous corporations like Walmart, Amazon, Apple, Exxon Mobil, and so forth., most likely couldn’t discover sufficient banks in the whole U.S. to unfold their money and keep under $250k at every establishment.

So, eliminate that silly $250k FDIC insurance coverage restrict! Successfully we have already got completed so after the most recent two financial institution failures at Silicon Valley Financial institution and Signature Financial institution. Why not make it official? Nothing within the Diamond-Dybvig mannequin says we must always restrict the deposit insurance coverage. Fairly the opposite, the implication from the Nobel laureates is that we are going to preserve repeating Silicon Valley Financial institution failures if a financial institution has sufficient uninsured deposits from giant enterprise purchasers. So, please spare me the Ethical Hazard platitudes!

Conclusion

Again within the late 90s in graduate college on the College of Minnesota, the 1983 Diamond-Dybvig paper was considered one of my favourite reads. The mannequin is easy and intuitive but affords wide-ranging and invaluable insights. Opposite to public opinion, deposit insurance coverage results in extra monetary stability, not much less. I feel that the considerations about ethical hazard are overblown. The advantages of deposit insurance coverage clearly outweigh the considerations over ethical hazard.

A lot for this week. Quite a lot of venting in the present day, I do know. However I hope you continue to loved it! Completely satisfied buying and selling by this risky market!

Thanks for stopping by in the present day! Wanting ahead to discussing this extra within the part under!

Title image credit score: pixabay.com

Associated

[ad_2]

Source link