[ad_1]

DollarBreak is reader-supported, while you enroll by hyperlinks on this publish, we might obtain compensation. Disclosure.

The content material is for informational functions solely. Conduct your personal analysis and search recommendation of a licensed monetary advisor. Phrases.

RealtyMogul is a dependable platform that caters to each accredited and non-accredited buyers. As the most effective platforms, RealtyMogul gives you with direct entry to extremely vetted business offers. It additionally gives non-accredited buyers the chance to purchase shares of two totally different REITs. The concept you could make investments as little as $5000 and generate earnings makes the platform interesting. Higher nonetheless, RealtyMogul focuses on high quality and intense due diligence, which implies it’s dedicated to satisfying buyers. Whereas its deal move of particular person properties isn’t very excessive, it has a robust monitor document of excellent choices that can assist you enterprise into actual property and discover high quality investments. If you’re seeking to diversify your portfolio and might comfortably meet the necessities, then RealtyMogul might assist you to.

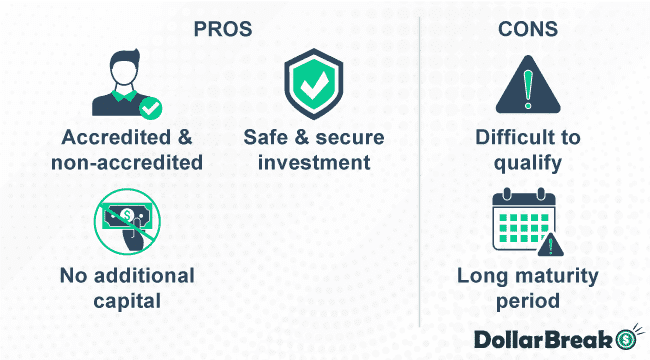

Professionals

- Appropriate for each accredited and non-accredited buyers

- Pre vetted funding thus protected and safe

- No capital calls required; therefore you’ll by no means be requested to offer further capital above your preliminary investments

- Provides extremely vetted business offers

Cons

- Troublesome to qualify as an accredited investor as most individuals as few individuals have had an annual earnings of $200000

- Maturity can take as much as 7 years.

Bounce to: Full Overview

Evaluate to Different Funding Apps

Fundrise

Put money into actual property properties with a $10 minimal preliminary funding

Historic annual return varies from 8.8% to 12.4% (2019 – 9.47%)

Low annual charges: advisory – 0.15%; administration price – 0.85%

Public App

Handle your portfolio of shares, ETFs, and crypto investments – multi functional place

Over 5000 shares and ETFs to select from (dividend shares accessible)

Comply with different buyers, see their portfolios, and alternate concepts

Acorns

Make investments your spare change in a diversified portfolio constructed by consultants

Count on as much as 7.5% yearly returns with plans ranging from $3 a month

Earn bonus investments from 350+ Acorns Earn companions

How Does RealtyMogul Work?

Began by Jullien Helman and Justin Hughes and based mostly in Los Angeles, RealtyMogul is a web-based crowdfunding platform that permits buyers to spend money on actual property with out shopping for one. Established in 2013, the corporate gives actual property funding belief and funding placement.

RealtyMogul means that you can take part in varied business actual property investments. Examples embrace self-storage, industrial websites, multi-family dwellings, workplace buildings, and retail buildings.

It additionally means that you can;

- Entry and spend money on personal placements and get uncovered to extra offers

- Put money into professionally managed and well-leased properties with the potential to generate earnings.

How A lot You Can Earn with RealtyMogul?

RealtyMogul gives focused returns based mostly on particular person offers supplied on its platform.

Presently, it has three providing listings, together with;

- Inside Fee of Return: 15.6% of self-storage and 26.1% on multifamily growth

- Money on money returns: Focused money on money returns vary from 5.9% to 7.5%

- Fairness A number of: This ranges from 1.51 occasions to 2.46 occasions

RealtyMogul Opinions: Is RealtyMogul Legit?

RealtyMogul is a web-based platform that has been working for over a decade and is backed by a number of enterprise capital corporations, therefore might be thought-about reputable. Whereas the platform has not attracted a variety of critiques, it has an A + ranking on BBB with few customers proud of its pre-vetted funding which are thought-about protected.

With a ranking of 3.3 on Trustpilot, one reviewer claimed that he had a 1-3 12 months maintain, and it’s been 4 years since he invested. In response to him, contacting them by no means bore any fruit as they proceed saying they’re sorry. In any other case, we will say that RealtyMogul is protected, safe, and legit.

Who’s RealtyMogul Greatest For?

RealtyMogul is for each non-credited and accredited buyers. Nevertheless, in case you are a non-credited investor, you may solely spend money on no-traded REITS. This implies you can’t spend money on standalone funding properties.

RealtyMogul Charges: How A lot Does it Value to Make investments with RealtyMogul?

Whereas RealtyMogul is free to hitch, you’ll must pay commissions that modify between 1% to 1.5% for REITs.As well as, the corporate costs administration charges as follows;

| Hybrid REIT | Fairness REIT | |

|---|---|---|

| Charges | Annual charges capped at 3% | Annual price capped at 3% |

| Asset Administration Price | 1% annual asset administration price billed month-to-month | 1.25% annual asset administration price billed month-to-month |

RealtyMogul Options: What Does RealtyMogul Supply?

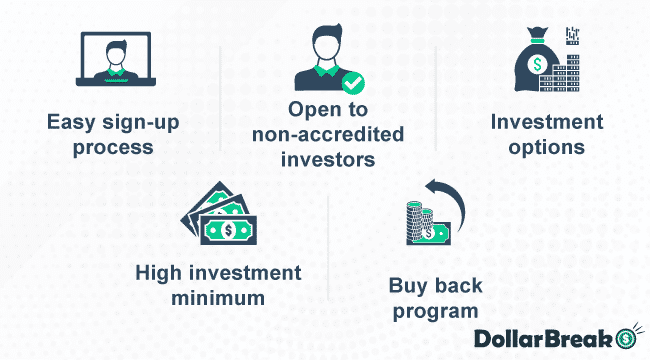

Simple Signal-Up Course of

Signing up with RealtyMoguls is a simple course of that solely requires three steps.

Open to Non-Accredited Traders

RealtyMogul gives nonaccredited buyers entry to the general public non-traded REITs, MogulREITs I and II. To take a position with the corporate, you have to be certified purchasers along with your funding not representing greater than 10% of your earnings. You possibly can enroll right here to get began.

Investments

RealityMogul gives public non traded REITs and personal placements, together with:

- MogulREIT I: This LLC invests in and manages a portfolio of actual property investments. As a public non-traded REIT, it’s registered with the Securities and Inventory Change Fee however not traded on inventory exchanges.

- MogulREIT II: That is additionally a public non-traded REIT that invests In frequent and most popular fairness investments in multifamily flats. Whereas its dividends are decrease than MogulREIT I, it goals for important worth appreciation over time.

Excessive Funding Minimal

Whereas RealtyMogul’s minimal funding varies by the funding, you could have at the very least $5000 to speculate with RealtyMogul.

RealtyMogul Purchase Again Program

RealtyMogul gives a program the place you may promote your MogulREIT I and MogulREIT II again to RealtyMogul quarterly for a decreased value for the primary 12 months. The corporate might purchase again your investments at a lesser share. This share relies on how lengthy you’ve held the funding.

As an example, you’ll be paid;

- 98% for those who’ve saved the funding for one 12 months or much less

- 99% for those who’ve held the funding for 2 years

- 100% for those who’ve held the funding for 3 years

- 0% When you’ve held the funding for lower than 1 12 months

RealtyMogul Necessities

To open an account with RealtyMogul, you could meet the next necessities;

- Minimal $5000 for REITs and $15000 for direct funding

- At the very least 18 years

- The US or worldwide resident

- Accredited buyers for direct funding and all buyers for REITs choices

Since Investments on RealtyMogul are illiquid and lack of capital is feasible, it’s worthwhile to evaluation danger components for personal placements earlier than investing your cash.

How Does RealtyMogul Shield Your Cash?

RealtyMogul maintains applicable bodily, digital, and procedural safeguards and controls to guard your funding. Whereas it’s not insured, it makes use of algorithms and mixed years of expertise to vet each element of each potential asset and guarantee your funding is protected.

Sadly, for those who lose your cash there is no such thing as a approach to declare compensation.

What are the RealtyMogul Professionals & Cons?

RealtyMogul Professionals

- Appropriate for each accredited and non-accredited buyers

- Pre vetted funding thus protected and safe

- No capital calls are required; therefore you’ll by no means be requested to offer further capital above your preliminary investments

RealtyMogul Cons

- Troublesome to qualify as an accredited investor as most individuals as few individuals have had an annual earnings of $200000

- Maturity can take as much as 7 years.

How Good Is RealtyMogul Help and Information Base?

RealMogul has detailed articles and movies on use the platform. You may also get in contact with them over stay chat, telephone, and electronic mail between Monday to Saturday 8 AM to six PM. With the brokers very pleasant and supportive, we will conclude that the assist is useful.

RealtyMogul Overview Verdict: Is RealtyMogul Value it?

RealtyMogul is a dependable platform that caters to each accredited and non-accredited buyers. As the most effective platforms, RealtyMogul gives you with direct entry to extremely vetted business offers. It additionally gives non-accredited buyers the chance to purchase shares of two totally different REITs.

The concept you could make investments as little as $5000 and generate earnings makes the platform interesting. Higher nonetheless, RealtyMogul focuses on high quality and intense due diligence, which implies it’s dedicated to satisfying buyers.

Whereas its deal move of particular person properties isn’t very excessive, it has a robust monitor document of excellent choices that can assist you enterprise into actual property and discover high quality investments. If you’re seeking to diversify your portfolio and might comfortably meet the necessities, then RealtyMogul might assist you to.

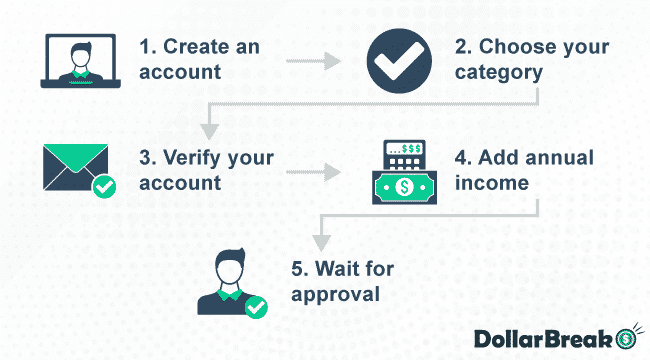

The best way to Signal Up with RealtyMogul?

To get began with RealtyMogul;

- Go to the web site and click on be a part of

- Select whether or not you’re an actual property firm or a person

- Enter your title, electronic mail handle, and telephone quantity and click on proceed

- Confirm your electronic mail handle, then proceed

- Add your annual earnings for the previous three years and web price

- Await approval

Websites Like RealtyMogul

RealtyMogul vs. Fundrise

Fundrise Abstract

- Low minimal beginning funding of $10

- Excessive historic returns of 8.8% to 12.4%

- 1% of administration charges

- Numerous portfolios of as much as 16 investments

Fundrise is a number one crowdfunding agency with a minimal funding of simply $500 in comparison with RealtyMogul’s $5000. Like RealtyMogul, Fundrise’s most important pursuits are common buyers looking for to hitch the actual property market.

Related in some ways, essentially the most notable distinction between RealtyMogul and Fundrise is that Fundrise has a decrease funding of $1000 and a less complicated price construction. Sadly, Fundrise doesn’t provide property listings like RealtyMogul.its gives are extra REIT centered

RealtyMogul vs. Crowdstreet

CrowdStreet is without doubt one of the most favourite rivals of RealtyMogul.Like RealtyMogul, CrowdStreet solely accepts accredited buyers with standards much like RealtyMogul. In comparison with RealtyMogul, CrowdStreet’s major focus is business actual property, with a few of them having double-digit anticipated returns.

Since these investments are long-term, you could allow them to maintain your cash for some time. CrowdStreet additionally has a minimal funding of $25000 with no possibility for early withdrawal. Whereas crowdStreet solely gives one providing for non-accredited buyers, it boasts greater deal flows than RealtyMogul, decrease charges, and extra transparency. In any other case, each platforms provide long-term investments.

RealtyMogul vs. Equitymultiple

EquityMultiple gives buyers professionally managed business actual property alternatives. In comparison with RealtyMogul, this agency allows you to spend money on funds or direct actual property alternatives. It additionally gives tax-deferred investing and focuses closely on institutional, business actual property.

RealtyMogul FAQ

What’s RealtyMogul?

Presently, the corporate has over 175000 buyers who’ve invested in additional than $375 and financed greater than 300 properties valued at $2.8 billion. The corporate additionally has above $100 million in funding distributions.

With the platforms 1031 alternate, you may defer your capital positive factors till you determine to promote your shares. Accredited by the Higher Enterprise Bureau, the corporate enjoys a ranking of A+ on BBB.

RealtyMogul Abstract of the Options

| Minimal Funding | 5000 |

|---|---|

| Accreditation Required | 1% TO 1.25%/12 months |

| Account Charges | 6 months |

| Time Dedication | Sure |

| Non-public REIT | Sure |

| Property Sorts | Business |

| Areas Served | 50 States |

How do you listing an funding alternative on RealtyMogul?

As soon as the corporate receives an software, it passes it by the due diligence course of whereas specializing in the challenge and the sponsor. A RealtyMogul consultant will then go to the property to verify its location and situation. If the challenge passes this, it will get listed.

Can RealtyMogul enhance your web price?

Sure, investing in RealtyMogul is without doubt one of the finest methods to extend your web price. When you arrange an auto funding plan and monitor it, your cash will develop as your web price will increase.

Which is healthier, Particular person Properties or REITs?

Whereas some individuals desire to speculate immediately in properties, others see REITs as the most suitable choice. So, this largely relies on your targets as an investor.

Does RealtyMogul spend money on multi-family houses?

Sure, RealtyMogul tends to deal with multi-family houses with strong money flows.

How do I withdraw cash from RealtyMogul?

When you’re a REITs investor, you may withdraw cash at a 2% penalty after the primary 12 months. However for those who spend money on particular person property, your funding will likely be locked up till the challenge is full.

RealtyMogul gives a REIT payback program however this relies on the corporate’s availability of capital. Additionally, the charges related to this program might be as much as 2%.

[ad_2]

Source link